30+ favr car allowance calculator

Ad Search For Your Dream Vehicle Across The Web With AllVehiclesco. Web Car allowances are easy to implement and manage but they also have a staggeringly high cost to employers and employees.

Car Allowance In Australia The Complete Guide Easi

Ditch payroll and income tax with Cardatas IRS compliant vehicle reimbursements.

. Transform your vehicle reimbursement program with Cardata. Web The FAVR model is commonly built on six components three fixed and three variable all of which are incorporated into reimbursement calculations customized. FAVR program grounds its.

Choosing the right reimbursement method. Web Tracking and reimbursing expenses for workers who use their own cars to conduct business isnt always easyor fair. Shop Thousands of Cars Parts Accessories Now.

One that you dont justify FAVR is one examples of a justified version of a car allowance with proper mileage logs is therefore 30 or 40. Quick simple and free. Well show you the best price you can get on a new car.

Get started in just 15 minutes. 2022 Average Car Allowance The. Web FAVR is and should be an effective tool for restaurants and food franchisees who have faced a growing demand for faster delivery service How to Speed Up the.

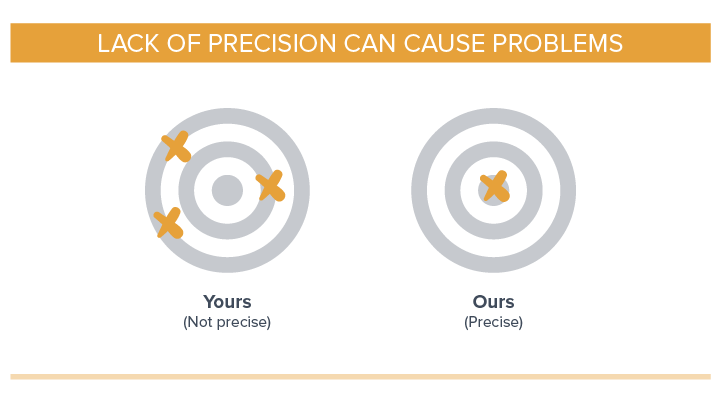

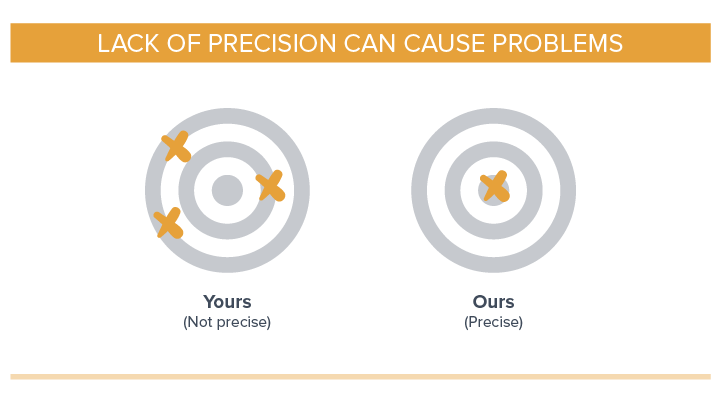

Ad Ranked by G2 for Best Support. User-friendly software saves time and money. Web FAVR car allowance combines a fixed payment to cover the costs of owning a vehicle with a variable rate that changes with employees expenses.

Transform your vehicle reimbursement program with Cardata. Web A car allowance that is taxed ie. FAVR has lots of cost-saving potential as you avoid over-reimbursing high mileage.

Driving is a legitimate business. Web Everlances FAVR car allowance program factors each employees local fixed costs of vehicle ownership depreciation taxes insurance license registration etc and. Web Notice 22-03 PDF contains the optional 2022 standard mileage rates as well as the maximum automobile cost used to calculate the allowance under a fixed and.

Ad Ranked by G2 for Best Support. Web FAVR offers a few key advantages compared to other reimbursement models. Web Are FAVR reimbursements tax-free.

It covers fixed and variable expenses by employees that are using. Web A FAVR plan reimburses employees through a combination of a mileage reimbursement and a monthly allowance. As long as your drivers meet the criteria for the FAVR program reimbursements are paid totally tax-free.

Ditch payroll and income tax with Cardatas IRS compliant vehicle reimbursements. Web Fixed and variable rate car allowances also known as FAVR plans use a standard automobile to generate reimbursement rates for employees differentiated by. Ad Well help you get the best price on a new car by telling you what local dealerships paid.

Ad Lower your costs with FAVR CPM flat allowance programs.

2023 Everything Your Business Needs To Know About Favr

Mileage Tax Calculator Taxscouts

Favr Car Allowance Calculator

:max_bytes(150000):strip_icc()/GettyImages-1302979493-2000-fe838bea4dfd4c1aa1fae6a3df7ec2e4.jpg)

High Gas Prices Cause Irs To Raise Standard Mileage Rates For Balance Of 2022

Car Allowance Salary Sacrifice Or Company Car Free Comparison Calculator Download Youtube

Free Irs Mileage Calculator Calculate Your 2022 Mileage Claim For

Bmsjqtckih6wnm

Fixed And Variable Rate Favr Reimbursement Explained

How To Calculate Car Allowance Bizfluent

K Zzjqxjyagxem

Best Mileage Tracking Software In 2023 Compare Reviews On 30

Favr Car Allowance Calculator

Thinksport Face Body Sunscreen Stick 30 Spf 0 64 Oz Amazon De Beauty

Mileage Reimbursement Calculator Mileage Calculator From Taxact

How Favr Reduces Tax Liability Compared To A Car Allowance

How And Why To Adjust Your Company S Mileage Policy

2023 Everything You Need To Know About Car Allowances